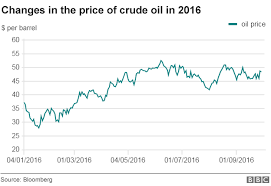

January 7th, 2017Want to profit from a rebound in oil prices?This is your chance.Having spent two years flooding the market with crude, OPEC is finally showing signs of fatigue. The group, led by top oil producer Saudi Arabia, has agreed to cut production for the first time since 2008. And Russia, the largest non-OPEC producer, has expressed a willingness to coordinate cuts of its own.Indeed, every major oil producer in the world has finally agreed that production is too high and prices too low. Action must be taken.Meanwhile, many U.S. shale producers, which cut into OPEC’s market share, have been driven out of business. More than 100 North American oil and gas companies have filed for bankruptcy. Their production isn’t coming back anytime soon.At the same time, demand is on track grow by more than 1 million barrels per day.The result: oil prices are set to rise in 2017.And our “2017 Oil Price Outlook: Inevitable Profits” has all the details.It explains exactly why oil prices are due to rise — how far and how fast.It also covers six investment opportunities that are set for a stellar year.Find out everything you need to know about:The U.S. shale collapseOPEC’s budget crisis2017 oil pricesHow to profitSo if you missed out on oil’s 2016 rally, don’t worry. We’ve got you covered for the year ahead.

Special Report Reveals: 3 Oil Stocks to Double for 2016

January 7th, 2017You know it, we know it: at some point, oil stocks are going to double or triple in price. It’s inevitable.Because oil prices are being artificially kept low by Saudi Arabia.And that manipulation simply can’t go on forever.But that doesn’t mean you can simply run out and buy the first oil stock you see. Because most U.S. oil companies loaded up on debt during the boom years.And that debt could be a big problem over the next few months — we’ve already seen several oil companies go bankrupt.You can protect yourself against the downside and still capture big profits when oil prices rebound — you just have to own the oil stocks with very small debt loads.Of course, it’s not always easy to find the companies with little debt. So we did the work for you…In our latest Special Report “3 Oil Stocks to Double for 2016” we’ve uncovered three U.S. oil stocks that have very little debt. That makes these stocks the perfect way to profit from the inevitable oil price rebound.These three companies are the cream of the U.S. oil stock crop.You’ll sleep easy knowing you have the most financially strong companies in your portfolio.

About Pipelines

If pipelines are taken out of service because they are no longer needed (retired), the costs and risks associated with the abandoned pipeline falls to the owner of the land where the pipeline is located.

Great Jobs

Great jobs for the right people that is. How would you like to be hundreds of feet in the air operating a tower crane? Or maybe the ability to move 10 tons of dirt with a flick of your finger sounds like fun. Maybe you would prefer to be on the inside using computers to regulate all the systems of a high-rise pipelines connection,

complex or other facility.

The capability to mend pipes to different sizes and generate go results.http://www.oilglobalcivilconstruction.netne.net